Unlock Editor’s Roundup for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

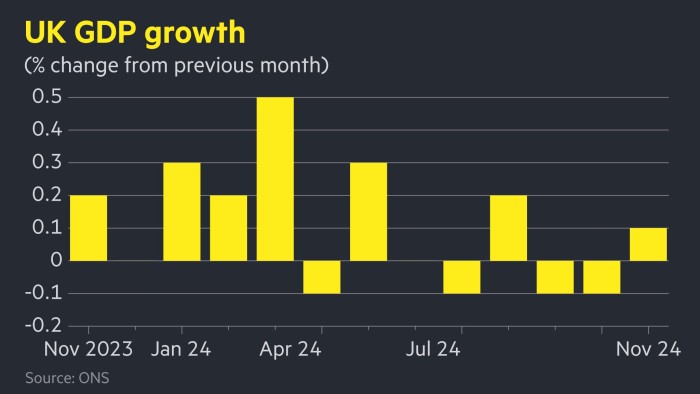

The UK economy grew 0.1 percent in November, missing analysts’ expectations but still marking the first expansion since August as Chancellor Rachel Reeves tries to rebuild confidence in her fiscal plans.

The monthly figure was below the 0.2 percent rise forecast by economists polled by Reuters and follows a 0.1 percent contraction in October and September, according to data released on Thursday by the Office for National Statistics.

November’s expansion was led by the dominant services sector, which rose 0.1 percent and offset a 0.3 percent contraction in manufacturing. The construction sector grew by 0.4 percent in November after a contraction of 0.3 percent in October.

Thursday’s data will not allay concerns over the performance of the UK economy as fears of stagflation, in which sluggish growth is accompanied by persistent price pressures, contributed to a sharp rise in borrowing costs at the start of of the year.

“This disappointingly modest return to growth for the UK economy is unlikely to ease stagflation concerns,” said Suren Thiru, Economic Director at the Institute of Chartered Accountants in England and Wales, ICAEW. “The increase in November is unlikely to have caused a more noticeable improvement in economic activity during the fourth quarter.”

The GDP figures follow official data released on Wednesday showing a surprise drop in inflation to 2.5 percent in December from 2.6 percent last month.

In the three months to November, the economy did not show growth compared to the previous three months. Output was also flat in the third quarter, which marked a sharp slowdown from the 0.4 percent expansion in the previous quarter. The increase was 0.7 percent between January and March last year.

After the release of the data on Thursday, Reeves said: “I am determined to go further and faster to jump-start economic growth, which is the number one priority in our Plan for Change.”

In December, the Bank of England said it expected no growth in the final three months of the year, down from a 0.3 percent expansion it had forecast in November.

The Bank of Albania left interest rates unchanged at 4.75 percent last month after cutting borrowing costs twice in 2024. Markets largely expect the bank to cut the key rate by a quarter of a point in February.

Sterling, which has fallen more than 2 percent against the dollar this year, was little changed at $1,221 after the data was released.

Experts polled by the FT expect the UK economy to outperform France and Germany, but warned that Reeves’ plans to increase employers’ national insurance contributions could damage the labor market. The chancellor announced her October budget increase, but it will only come into effect in April.