Unlock the digestive of free editor

Roula Khalaf, the FT editor, chooses her favorite stories in this weekly newsletter.

ARM plans to launch its chip this year after providing Meta as one of its first customers, in a radical change in the business model of the softbank group owned by the licensing of its projects for Apple and Nvidia.

Rene Haas, the chief executive of ARM, will discover the first chip he has made inside the house since this summer, according to people familiar with the plans of the UK -based group.

The measure from the design of the basic blocks of a chip to make its full processor can also increase the balance of power in the semiconductor industry by $ 700BN, incorporating the wing into competition with some of its larger customers.

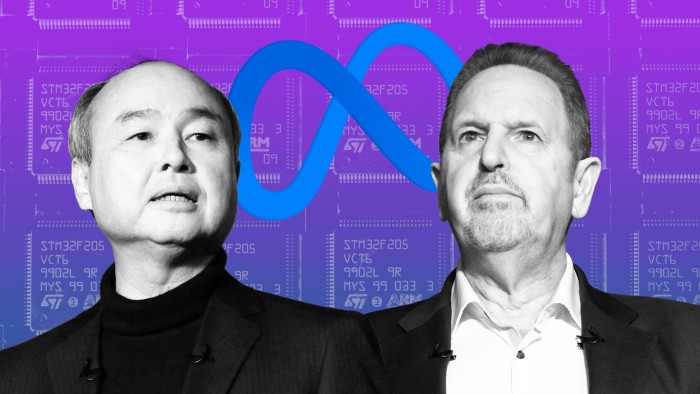

The founder of Softbank Masayoshi Son has placed his arm at the center of his plans to build an extensive network of infrastructure for artificial intelligence. The launch of the ARM itself is considered only one step in its biggest plans to move on to the production of it, people say familiar with plans.

Last month, Son discovered his Stargate initiative, in which he and Openai plan to spend an alleged $ 500 billion infrastructure, with the State Fund Abu Dhabi Mgx and Oracle also providing funds for the US -centered project. ARM is a leading technology partner for Stargate, along with Microsoft and Nvidia.

The ARM IPIP is expected to be a central processing unit (CPU) for servers in large data centers and is built on a base that can then be customized for clients including Meta, according to those familiar with plans. Production will be transferred from a manufacturer such as TSMC, these people said.

Softbank is also closing on the purchase of Ampere, a designer of oracle -backed chips of ARM -based chips for servers that can be estimated at close to 6.5bn $. This agreement is essential for the project of the ARM itself, people familiar with the plans said.

The Cambridge -based wing has doubled more than the value of $ 160 billion, when ranked in Nasdaq in 2023, highly committed by the interest of explosive investors. ARM with Nvidia and Amazon partnerships have prompted its rapid growth in data centers that empower the assistants of Openai, Meta and Anthropic.

Meta is the latest large technology company that turns to the arm for server chips, shifting what is traditionally offered by Intel and AMD.

When calling last month’s earnings, Meta Finance Chief Susan Li said it would be “expanding our ordering silicon efforts to (it) training loads” to run greater efficiency and performance while accorded chips to his special computing needs.

Meanwhile, a chip produced by ARM is also likely to eventually play a role in Sir Jove’s secret plans to build a new type of empowered personal device, which is a collaboration between iPhone designer firm Lovefrom, Sam Altman of Openai and Softbank.

ARM models are used in more than 300Bn chips, including almost all the world’s smartphones. Its energy efficiency models have made its CPUs, working bait with general goals sitting in the heart of any computer, an increasingly attractive alternative to Intel chips on PCs and servers at a time when he is makes data centers much more intense energy.

ARM, which began in a converted Turkey barn in Cambridgeshire 35 years ago, became ubiquitous in the mobile market by licensing its models on Apple for iPhone chips, as well as Android suppliers like Qualcomm and Mediatek. Maintaining its unique position in the center of the competitive harsh mobile market has requested a careful act of balancing for ARM.

But the boy has long been pressured to make more money from his intellectual property. Under Haas, who became CEO in 2022, the ARM business model began to evolve, with a focus on running the highest royalties by customers as the company designs more building blocks needed to make a chip.

Going a step further by building and selling its full chip is a bold action by Haas that risks putting it in a course of clash with clients such as Qualcomm, which is already involved in a legal battle with the wing on licensing conditions, and Nvidia, the most valuable chipmaker in the world.

The arm, softbank and meta refused to comment.

Additional reporting by Hannah Murphy