Unlock the White House View Newspaper FREE

Your guide to what the 2024 American elections mean for Washington and the world

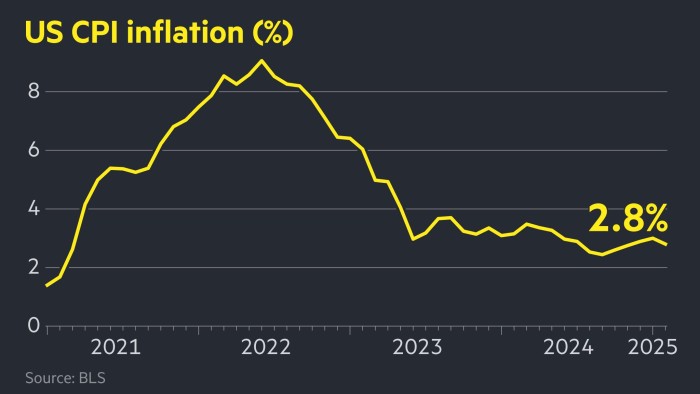

American inflation fell more than expected 2.8 percent in February, strengthening the issue that the federal reserve reduces interest rates between growth growth signs in the world’s largest economy.

The annual figure of the Wednesday consumer index was under 3 percent of January and 2.9 percent expected by economists, according to a Reuters survey.

US shares have fallen in recent weeks, but increased Wednesday, with the Blu-Chip S&P 500 closing 0.5 percent higher and the composition of heavy NASDAQ technology, adding 1.2 percent.

Future markets are prices in two decreasing rates this year with a chance of approximately 85 percent of one -third – to marginal way from before data release.

The US Central Bank faces a difficult act of balancing as it tries to reduce inflation without causing a recession, amid fear that intensifies that President Donald Trump’s aggressive economic agenda is preventing growth.

Businesses and financial markets have been shocked by the chaotic participation of the president’s tariffs for the largest US trading partners, which is marked by unexpected escalations and Us.

Wednesday figures showed that essential inflation increased 3.1 percent, not expecting expectations for an increase of 3.2 percent.

“Basic inflation is slowing down before we reach those fees overthrow risks, which will come later in the spring, so it is positive for the Fed,” said Veronica Clark, an economist in Citigroup. “It will make them less worried about planning cuts later during the year.”

Last week, Fed President Jay Powell played concerns about the health of the American economy after profits after the S&P 500 index elections were deleted after the issuance of disappointing employment figures for February.

Powell suggested that he expected the Central Bank to hold norms in their current interval between 4.25 percent and 4.5 percent in its meeting next week, saying the Fed was not in any “hurry” to cut and “focused on the signal separation from the noise while the prospect evolves”.

Canada Bank on Wednesday lowered interest rates by a quarter point to 2.75 percent, citing the expected slowdown from “raised trade tensions and tariffs set by the United States”.

Although she said Canada’s economy had begun the year in good shape, BOC also noted the slowdown of economic activity at the US and warned that its view was more difficult to understand “more than the usual uncertainty due to the rapid developing policy landscape”.

Some economists and investors are afraid that Trump’s tariffs will promote US inflation at the price of some metals, including aluminum, rising after the administration imposed steep tariffs for imports from Wednesday.

The White House decision to impose 25 percent taxes on all imports of steel and aluminum caused rapid revenge from the EU, which is aiming for up to 26Bn € of American goods with tariffs.

Tom Porcelli, the head of the US economist in the fixed income of the PGIM, said February’s fall was welcome, but said facilitating investors could be short given the potential impact of tariffs.

In February, sectors that recorded the highest price increase included medical care and used cars, while air flights and new cars were among those where costs were reduced.

Eggs, an important contributor to strong January reading, were again higher in February, increasing a further 10 percent per month for an annual increase of 59 percent.

“It is good news, surely, but I think we don’t want to overdo it,” said Ryan Sweet, US economist chief at Oxford Economyics. “Only tariffs for China had entered into force in February and may be a little quickly to get caught in this round of data.”