Stay informed with free updates

Simply sign up at US inflation Myft Digest – delivered directly to your box.

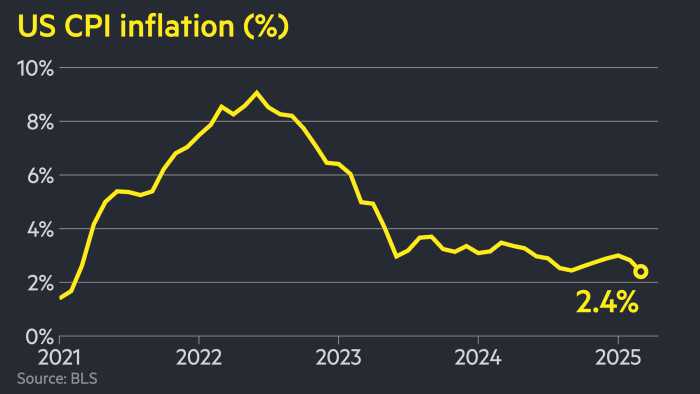

American inflation fell more than expected at 2.4 percent in March, as the Federal Reserve deals with how to respond to President Donald Trump’s unexpected ultrasters with tariffs.

The annual figure of the Thursday’s Consumer Price Index by the Bureau of Labor Statistics was under the February reading of 2.8 percent and the forecast of 2.5 percent by the economists surveyed by Bloomberg.

The data also showed that basic annual inflation increased by 2.8 percent, less than February reading by 3.1 percent and under the expectations of economists of 3 percent.

The future of the stock shorten their losses and treasury yields fell into weaker inflation data than expected after investors escalated bets in lowering the nutrients.

The future of S&P 500 decreased about 2 percent on Thursday, while the two-year treasure yield fell to 3.8 percent, reducing 0.11 percentage points per day.

Traders in the future market modestly reduce interest rate expectations, still prices between three and four cuts to December.

The Central Bank faces a dilemma if it will lower the rates to prevent a possible slowdown caused by Trump’s comprehensive tariffs for US trading partners, or keep them higher to predict an inflation revival.

On Wednesday, the US president announced that he would stop the “reciprocal” steep tariffs for US trading partners for 90 days. The mass sent us increasing shares, with S&P 500 by posting its best day since 2020.

However, China was denied a pause and its rate increased to 125 percent, while 10 percent tariffs already set in most countries remained in the country.

March figures precede US implementation this week at a 10 percent universal tariff, along with large tasks for Chinese goods – factors expected to be inflationary.

Federal reserve officials have noticed in recent weeks that tariffs are likely to increase inflation and slow growth.

Minutes from the Central Bank March policy meeting showed that “Most participants noticed the possibility of inflationary effects stemming from various factors to be more persistent than anticipated”.