Unlock the White House View Newspaper FREE

Your guide to what Trump’s second term for Washington, business and the world mean

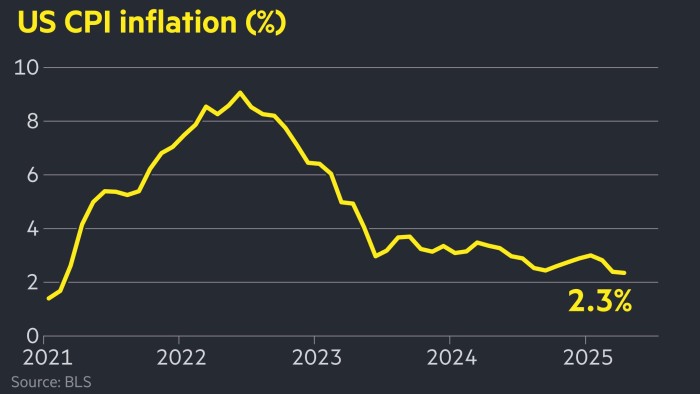

American inflation fell to 2.3 percent in April, the month of Donald Trump set his global tariffs, as the US president holds pressure on the federal reserve to lower interest rates.

The annual figure of the Tuesday Consumer Price Index by the Bureau of Labor Statistics was under the expectations of analysts surveyed by Bloomberg that inflation would remain at 2.4 percent of March.

But prices rose 0.2 percent per month a month, compared to a decrease of 0.1 percent in March.

Although Trump has reduced many of the tariffs he announced on April 2 – including this week with China – economists warn that most of the impact of import tasks has not yet felt, with FED officials who foresee further increase in price pressures.

The April figure was brought to a lower price for services such as air flights, hotels and sports events. Foods fell 0.4 percent, led by a drop of 12.7 percent of egg prices, while they returned some of their growth of bird flu.

“Everyone is looking at the impacts of tariffs,” said Andrew Hollenhorst, economist at Citigroup. “And we didn’t see it in today’s report.”

The essential rate of inflation, which excludes changes in the price of food and energy products, remained at 2.8 percent in April, BLS said.

The Yale Budget Laboratory, a university research organization, said Monday that, due to tariffs, the average US consumer would pay $ 2,800 more for products this year than in 2024.

“We expect to see some tariff impacts on the CPI reports of May and June, so the Fed has a long run to observe the data in the introduction,” Durham Abric in Citadel Securities said.

The US Central Bank, which has held tariffs in the range of 4.25 percent to 4.5 percent for six months, meets another in June.

Trump has raised pressure on Jay Powell to reduce borrowing costs, adding last week that the treatment of the Fed chair was like “talking to a wall”.

US shares opened slightly higher, with S&P up to 0.3 percent and the nasdaq ingredient up to 0.6 percent.

The dollar index, which measures the US currency against a basket of six rivals, was 0.4 percent lower.

The two-year treasure yield, which follows interest rate expectations and moves in the opposite way, was slightly lower, below 0.04 percentage points to 3.97 percent.

Traders expect the Fed to lower interest rates twice this year, with a small chance of a third cutting of the third trimester, approximately as they had in front of inflation data.

The FED’s preferred inflation goal is not IIK, but personal consumption costs, which fell to 2.3 percent in March, but remained over the 2 per cent Central Bank goal.