Stay informed with free updates

Simply sign up at net Myft Digest – delivered directly to your box.

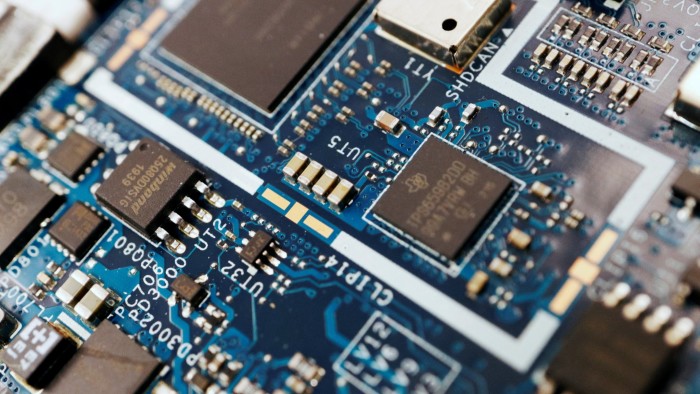

Chipmakers in Asia and Europe withdrew Wednesday after strong corporate profits from the Dutch Group ASML added to the last day rally in the Nvidia industry leader.

The recovery came after the American chipmaker Nvidia closed nearly 9 percent American supremacy in artificial intelligence.

The appearance of Deepseek, which promises to develop the tools of him in a part of the cost of American rivals, has been called a contemporary “sputnik moment”.

Stoxx Europe 600 Benchmark increased by 0.5 percent, led by ASML. Chip equipment manufacturer announced revenues that beat analysts’ expectations, sending its shares 10 percent higher in Amsterdam.

ASM, another chip, increased 7 percent, while the Stoxx Europe 600 technology index increased by 4.3 percent, rather than wiping Monday’s road.

“What happened on Monday was an extreme reaction that was reinforced by extreme positioning,” said Elyas Galou, a global investment strategist in the Bank of America, showing stuffed positions in global technology shares that went to the US president’s inauguration Donald Trump and before this week’s profits by BellWethers Tech including Meta and Microsoft.

“We saw many purchases yesterday, including by retail investors, which is supporting the market today,” he added.

Nvidia’s shares were flat in trading before the market Wednesday. Future markets showed a further return to the US, with contracts that follow up to 0.3 percent and those following the S&P 500 apartment.

Japan’s heavy Nikkei Nikkei 225 closed 1 percent after a return to semiconductor shares and investors of that softbank.

“The markets have taken a quieter look at developments in China with him and maybe it is a reflection that Monday’s movements were an excessive reaction,” said Mitul Kotecha, head of developing macro markets and foreign exchange strategy at Barclays.

Asian market analysts at Goldman Sachs writes in a Note Tuesday evening that “high quality shares can also offer some investment opportunities”, adding “we think strong enterprises will become even stronger”.

In Tokyo, supplier Nvidia Advantest closed 4.4 percent while the semiconductor company Tokyo Electron increased 2.3 percent. Softbank ended the day with an increase of 2.4 percent.

The markets in the rest of Asia were also soft on Wednesday. India’s NIFTY 50 was nearly 1 percent in the afternoon trade while ASX 200 Australia closed 0.6 percent. China, South Korea and Taiwan are closed for New Year’s lunar holidays.

However, analysts warned that the recovery had not fully dismissed panic declines on Monday, while investors digests the implications of heavy investment by American technology in the light of Deepseek’s achievements.

“There was no comeback like” Oh, it was nothing. “Just a reflection that the moon’s mass was an excessive surplus,” said Kotecha and Barclays.