Unlock the digestive of free editor

Roula Khalaf, the FT editor, chooses her favorite stories in this weekly newsletter.

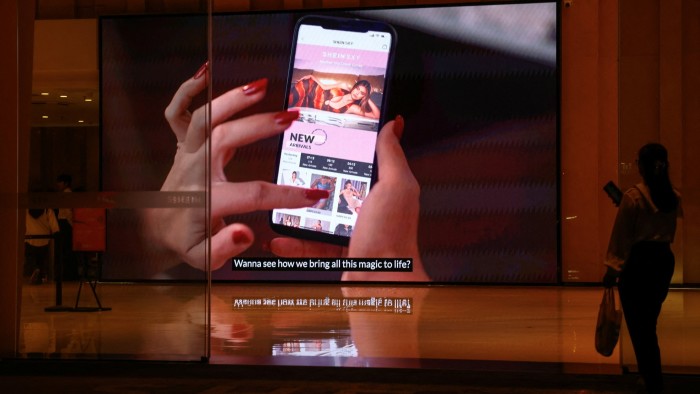

The Chinese giants of E -Commerce Temu and Shein have reduced their expenses in the US on advertising platforms and said they will raise prices later this month, as they struggle with the completion of tax exemptions that have helped them underestimate rivals like Amazon.

Temu shorten its spending on the platforms including Meta, X and YouTube alphabet with an average of 31 percent in two weeks leading on April 13 compared to last month, according to estimates from the tower of market intelligence group sensors.

The smartest data of E -Commerce also revealed that TEMU had allocated all the expenses to the Google Purchase Platform since April 9, when China’s wide tariffs were introduced.

In an email to clients on Wednesday, Temu said that because of “global trade and tariff rules, our operating expenses have increased” and would make “price adjustments” starting April 25. Shein sent an almost identical email with the same date.

Advertising advertising and rising prices by two sellers, who have grown rapidly in the US since Pandemia Covid-19 at the expense of competitors including Amazon, show the widespread impact of President Donald Trump’s trade conflict with China.

Movements will affect US consumers and can damage social media platforms, including meta, that provide advertising space for Chinese retailers so that they can reach the Western audience.

Temu and Shein were affected by the White House decision last week to set up tasks for low value packages arriving from China to 90 percent of the value of a parcel, or a flat fee of $ 75 to $ 150. The measure, which comes into force on May 2, will end the exclusion of “De minimis” that enables goods worth less than $ 800 to be sent without liabilities to American clients.

Western rivals have criticized both companies for their underestimation and the sale of goods under standards.

“The decision to close the deplete destine gap has been a killer of weeds,” said Mike Ryan, an analyst in the smarter E -Commerce.

Temu and Shein have spent billions of dollars engaging in a US advertising advertising in recent years, but each one owns less than 1 percent of the country’s E -Commerce market, according to the Consumer Edge Analytical Company.

Meta income from China was $ 18.4 billion last year, or more than 10 percent of its total $ 165BN, according to financial discoveries. In January, she cited trade fees or disputes as a potential risk to his business, saying she generated “significant income from a small number of sellers serving China -based advertisers”.

The two retailers are now withdrawing. The average daily spending of Shein in Meta, Tiktok, YouTube and Pinterest dropped 19 percent in the first two weeks of April as the tariffs were imposed, the sensor tower records show. It has almost halved its spending year by year, lowering dollars from YouTube advertising in particular.

Temu raised expenses on US platforms so significantly last year that it was still above 2024, despite the latest reduction, the data show. Temu was the best advertiser in Elon Musk in the SH.BA in 2024.

Meta and X refused to comment. Google, Temu and Shein did not immediately respond to comment requests.

James McDonald, director of data intelligence and forecasting at Warc Marketing Intelligence Company, said advertising cuts would have an impact on sale because both companies lacked enough brand loyalty. “They have to advertise constantly to keep customers.”

Both companies were responsible for more than 30 per cent of about 1.5 million small shipments without tariffs at the US, according to a 2023 Congress report and US customs data.

Tasks for low value packages are even less than tariffs for Chinese imports, which add up to 125 percent.