Unlock the digestive of free editor

Roula Khalaf, the FT editor, chooses her favorite stories in this weekly newsletter.

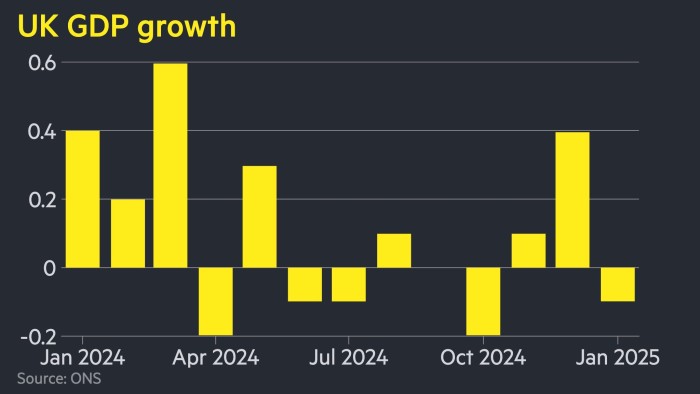

The United Kingdom economy was suddenly contracted by 0.1 percent in January, underlining the challenge facing Chancellor Rachel Reeves as he prepares to make a spring statement of high interest this month.

Friday’s monthly GDP figure by the Office for National Statistics was under 0.1 percent growth provided by economists surveyed by Reuters and 0.4 percent of December. The decline was mainly driven by weakness in the production sector.

Reeves is preparing to restore public spending on her spring statement on March 26 after a disappointing increase and government borrowing figures aroused fear that she is on the right track to break her fiscal rules.

Growth has been stuck mainly since May, hitting tax revenue, as the United Kingdom economy withdrew from a technical recession in early 2024.

The October Budget Liability Office provides for economic growth for 2025 to 2 percent – double 1 percent provided by economists surveyed by Reuters. The defense counsel is expected to issue a new forecast along with the spring statement.

Suren Thiru, the Director of Economy at the Institute of Authorized Accountants, said that the January GDP shrink made the “more problematic” spring statement as it increased the opportunity to minimize its predictions, “further undermining the Chancellor’s spending plans”.

Pound was weakened shortly after Friday data releases, down 0.2 percent to $ 1,292. Gilts were stable in early trade, with a flat 10-year yield to 4.68 percent.

The figures come after the consequences of the escalating trade war and Donald Trump has added to the economic strains faced by the United Kingdom, as well as the prospect of higher defense spending after the US president disrupts Western security alliances.

“The world has changed and all over the globe we are feeling the consequences,” Reeves said in response to Friday figures.

As a result, she said, “we are starting the greatest continued growth of protection spending from the Cold War, radically reshaping the British state to offer people working and their families, and taking the blockers to get the building of Britain again.”

The Labor Party won the general election last July with a promise to start growth, but Reeves has faced criticism of its October budget, which left businesses holding the $ £ 40 billion burden on tax growth.

Businesses have warned of job cuts as a result of measures, which take effect from April.

Paul Dalles, economist in consultancy, said the January decline “highlights the weakness of the economy before the full effects of increasing business taxes and the uncertain global backdrop”.

The Bank of England is expected to hold tariffs at 4.5 percent in its meeting next week between signs of an inflation return. Last month, the Central Bank lowered its economic growth forecast for the first quarter of 2025 to 0.1 percent, from 0.4 percent expected in November.

Despite the January shrinkage, Thiru said a decrease in the rate from the BOE next week was “impossible” as the norm determinants would probably like to appreciate the impact of increasing the national insurance contributions from the budget.

Friday’s data ceased traders’ expectations that there will be at least two further discounts of interest rates in the quarter of BOE this year, with the low chance of one -third, according to the levels implied by the markets of exchanges.

According to Friday’s EB data, the production sector contracted 1.1 percent in January, with a decrease of 0.2 percent of construction, while services increased 0.1 percent.

Liz McKeown, director of Inel’s economic statistics, said the general photo of the UK economy was of “poor growth”.

However, services continued to grow in January, she said, “led by a strong month for retail, especially food stores, as people ate and drank more at home.”

Ines said that the publication of commercial data, usually released along with GDP figures, was delayed due to errors.