Stay informed with free updates

Simply sign up at UK inflation Myft Digest – delivered directly to your box.

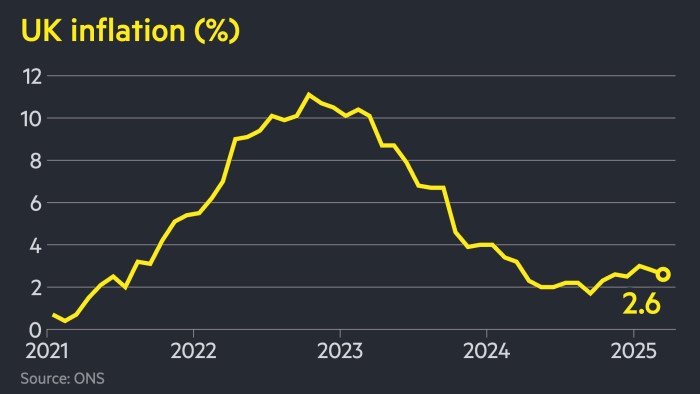

UK inflation fell more than expected to 2.6 percent in March, strengthening the issue of the Bank of England lowering interest rates next month, as it makes the economic impact of US President Donald Trump’s tariffs.

The annual increase in consumer prices, reported by the Office for National Statistics on Wednesday, was under the forecast of 2.7 percent by economists in a reuters survey and from 2.8 percent in February.

The figures showed the largest falling factors were the lowest prices for gasoline and for games, toys and hobbies – in particular computer games.

But the inflation of services, a major amount of fundamental price pressures for rate determinations, slowed more than expected to 4.7 percent in March from 5 percent in February. Food inflation was also relieved, from 3.3 percent to 3 percent.

“Once, the UK inflation fell for the right reasons,” said Tomasz Wieladek, European Chief European Chief in Rowe Price, who said inflation of the softer services would give BO’s confidence “that the UK Disinflation process is on the right track and allows the Central Bank to decrease in May.

After the issuance of data, traders ceased their bets in at least three quarter cuts from BOE to the end of the year, according to the levels implied by the exchange markets, with the possibility of first coming to the May meeting set at 85 percent.

The yield in two-year gilts, which move with interest rate expectations, dropped 0.06 percentage points to 3.91 percent.

Pound initially lowered lower to the dollar after data before recovering the land, with 0.3 percent by $ 1.328 a day.

Wieladek added that the mildest inflation data and the fear of trade had opened the door to “at least four” rate landing this year.

Rachel Reeves, the Chancellor, said that two months of declining inflation, combined with GDP growth and real wages, were “encouraging signs” – opposing claims from the Chancellor of Mel Streed Shades that government policies were “keeping inflation for longer”.

But economists said DIP would not prevent inflation from deducting in April, reflecting sharp increases in regulated household bills and that long -term prospects will depend on how global trade policy evolved.

“The truth is that the perspective on UK inflation depends on President Trump’s tariff policies,” said James Smith, research director at the Think-Tank Resolution Foundation.

BOE has balanced the risks of a job weakening market against continued pressures of increasing strong salaries and higher home bills.

The Central Bank’s monetary policy committee said last month that it would adhere to a “careful and gradual” approach to lower borrowing costs after maintaining interest rates to 4.5 percent.

But the impact of a global trade war will now prevail in BOE’s opinion.

The United Kingdom has been hit by 10 percent of Trump 10 percent and from 25 percent of the White House tax imposed on imported and steel cars. But economists say the slowest global growth and the unpredictable effects of trade deviation will have a greater impact on the United Kingdom economy.

Clare Lombardelli, a deputy governor at BOE, said last week that tariffs are likely to depress economic activity, but that their effect on inflation would be more difficult to predict.

“Global trade uncertainty can lower our prices, with oil already more than 10 percent since the beginning of April – but a global trade war would create renewed inflation,” Smith said.

Ruth Gregory, Deputy Chief Economist in the United Kingdom in Consulting Capital, said the shock of tariffs “has bowed the balance of risks to lower inflation and the rapid decline in interest rates”.

The divided figures published by Ines on Wednesday showed that families in the UK had also seen relief from a long period of high rise in private rent prices.

The average rents increased 7.7 percent per year in March, from an annual growth rate of 8.1 percent per year to February, and a high record of 9.1 percent in March 2024.

The annual increase in UK house prices rose to 5.4 percent in February, from 4.8 percent a month ago, as buyers rushed through purchases before the stamp task ended.