Unlock Editor’s Roundup for free

Roula Khalaf, editor of the FT, picks her favorite stories in this weekly newsletter.

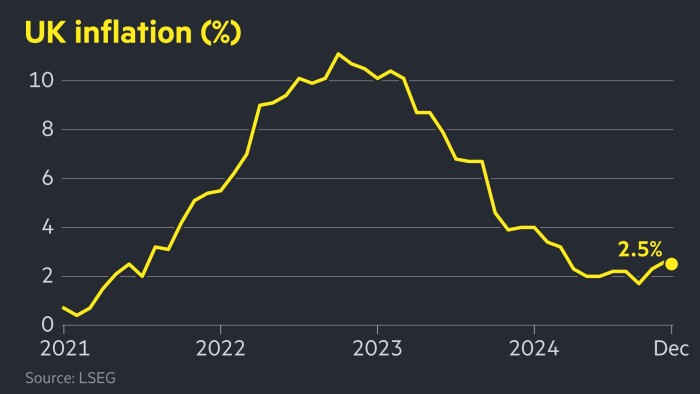

UK inflation unexpectedly slowed to 2.5 percent in December as the economy weakened, easing pressure on Chancellor Rachel Reeves and paving the way for the Bank of England to push ahead with interest rate cuts.

The consumer price index figure was below November’s 2.6 percent reading. Analysts had expected inflation to hold steady last month.

The data will provide relief to Reeves, who is struggling with higher borrowing costs that have been fueled by fears that the UK economy could enter a period of stagflation.

On Tuesday, Reeves rejected calls for her resignation after her Conservative opposite number Mel Stride accused her of overseeing a “Shakespearean tragedy” as borrowing costs hit a 16-year high.

The Office for National Statistics report comes as the BoE’s Monetary Policy Committee prepares to hold its first meeting of 2025 early next month. Investors are betting that the central bank will cut rates by a quarter point to 4.5 percent.

Tomasz Wieladek, chief European economist at T Rowe Price, said the data was a “clear green light for another round of cuts”.

The Bank of Albania has estimated that the economy has stalled in the last quarter of 2024. Business surveys point to weaker confidence and employment, which could curb inflationary pressures.

Wednesday’s data showed that services inflation, which is closely monitored by the BoE as a gauge of underlying price pressures, slowed sharply to 4.4 percent from 5 percent previously.

Core inflation, which excludes food and energy, fell to 3.2 percent from 3.5 percent.

The pound weakened slightly after the data was released, falling 0.3 percent on the day to $1.218. Traders in the exchange markets had attributed a 60 percent chance of a quarter-point decline next month, based on levels before the data release.

The central bank cut its key rate to 4.75 percent in two quarterly moves last year.

Additional reporting by Ian Smith