Stay informed with free updates

Just log in inflation in the US myFT Digest — delivered straight to your inbox.

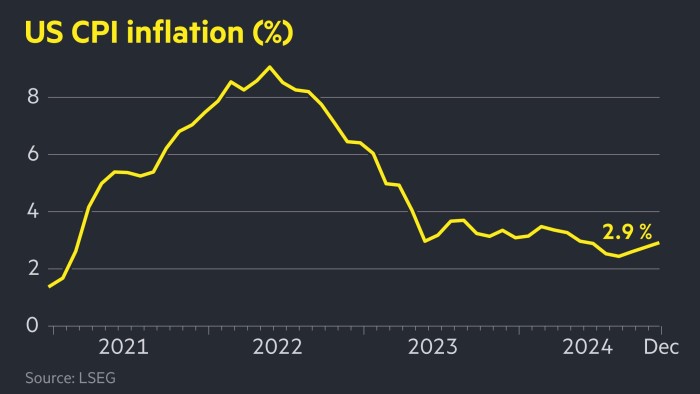

US inflation rose to 2.9 percent in December, in line with expectations, strengthening the case for the Federal Reserve to slow its pace of interest rate cuts this year.

Wednesday’s data from the Bureau of Labor Statistics matched the forecast of economists polled by Reuters and were above November’s figure of 2.7 percent.

The annual inflation figure, the latest before Donald Trump is sworn in for a second presidential term on Monday, comes days after US job growth in December blew past expectations.

Labor market data deepened a sell-off in Treasuries as investors bet the US central bank will have to keep interest rates higher for longer this year.

Core inflation, which strips out food and energy prices, was 3.2 percent in December compared with 3.3 percent in November.

Fed officials have already signaled that they plan to take a “cautious approach” to cutting rates amid growing concerns that inflation may fall short of the central bank’s 2 percent target.

Most investors and analysts believe the Fed will not cut rates again at its next policy meeting later this month. US central bankers have signaled in their projections that they will cut rates by only 50 basis points this year.

The renewed anxiety over inflation comes as Trump has unveiled aggressive plans to impose tariffs on a large swath of imports, implement a major crackdown on undocumented immigrants and enact across-the-board tax cuts.

Economists have warned that these plans could further fuel inflation.