Amazon has agreed to buy Indian buy now pay later startup Axio, deepening its push into financial services in one of its fastest-growing markets.

The US technology group, which has held an equity stake in Axio for six years, signed the acquisition agreement in December after completing due diligence, the Indian startup said in a blog post.

Financial terms were not disclosed, but two people familiar with the matter told TechCrunch that the size of the deal is over $150 million. The deal requires approval from India’s central bank.

The Bengaluru-based startup, formerly known as Capital Float, raised $135 million in equity from investors including Peak XV Partners, Ribbit Capital, Elevation Capital over the years.

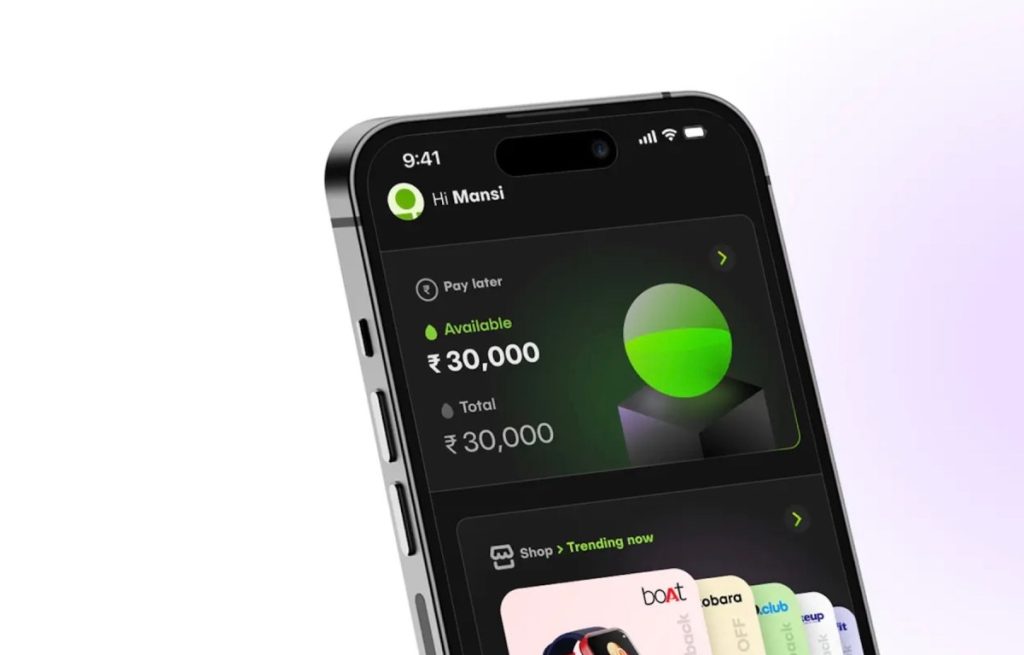

The startup, which specializes in providing small loans to self-employed individuals and households at points of sale on leading e-commerce platforms including Amazon and MakeMyTrip, said it serves more than 10 million customers and has built a loan book of 260 million dollars.

Axio is among a group of Indian startups operating in a market where traditional access to credit remains limited – India has low credit card penetration and conventional banks often find small-ticket loans unprofitable.

The startup sought to address this gap by building a regulated lending platform that can rapidly assess creditworthiness, making loan decisions “within two clicks and five seconds.”

But like many other startups in this category, Axio has also struggled to maintain its growth. Goldman Sachs-backed ZestMoney, which operates in a similar space and was once valued at $450 million, also struggled and was eventually picked up by a traditional firm in a fire sale.

Axio is the second startup that Amazon has acquired in India, where it has distributed more than $10 billion to date. Amazon bought video-on-demand streaming service MX Player in June last year.