Softbank is in talks to invest up to $ 25 billion in Openai, as part of a wider partnership that can see the Japanese conglomerate spend more than $ 40 billion on the initiatives supported by Microsoft, according to Financial Times.

Possible investment would make the largest Softbank Openai supporter, the report said, exceeding Microsoft who for the first time invested in Chatgpt manufacturer in 2019 this could be expanded to $ 500 billion over four years.

Softbank plans to invest $ 15-25 billion directly in Openai in addition to his $ 15 billion Stargate engagement, the report said. Openai will invest about $ 15 billion in Stargate, with softbank capital investments that potentially cover the commitment of OpenAi’s infrastructure.

The talks come at a time when the release of the Chinese deepseek firm of its R1 reasoning model, which was built on a relatively modest budget, showed public markets shocked this week.

Chip Giant Nvidia lost up to $ 589 billion in a day before it made easy recovery, as investors worried that large investments in expensive equipment could not be needed if companies could achieve similar results with few resources.

Openai claimed earlier this week that he had found evidence that Deepseek used its owner models to train its open source competition through a technique called “distillation”, which allows developers to achieve similar results in more models small at a much lower cost. The company says this will violate its service conditions, which prohibit the use of results to develop competitive models.

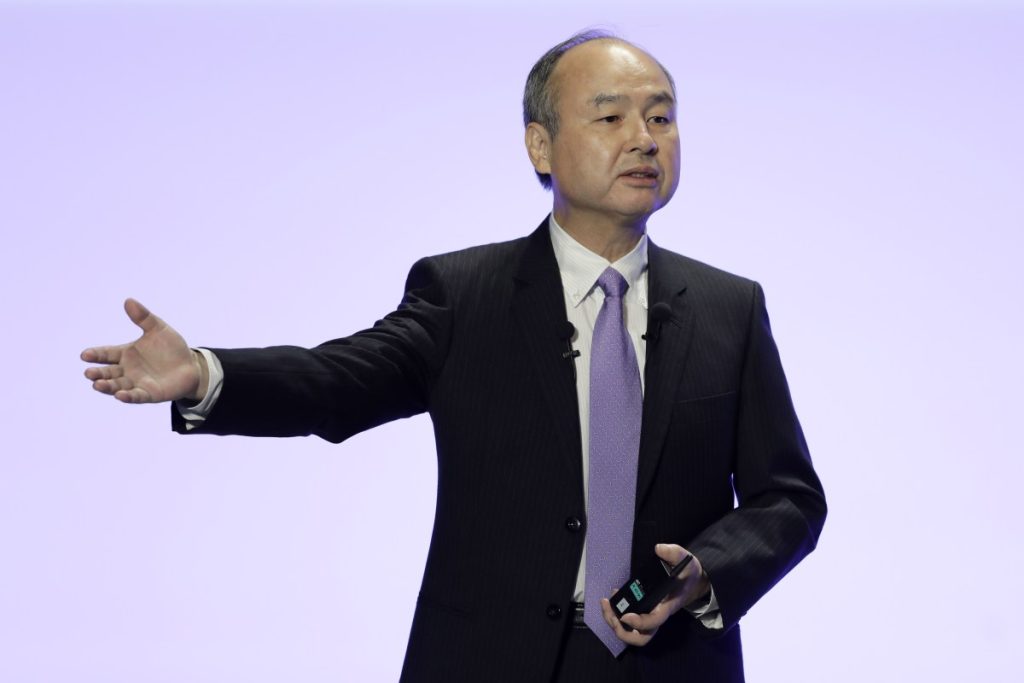

The Opennai deal with Softbank, which the Financial Times says has not completed, represents the largest bet of the founder of Softbank Masayoshi Son since injection of $ 16 billion in Wework. He would also reduce Openai’s dependence on Microsoft on computing sources, with Microsoft recently agreeing to give up his position as the exclusive provider of Openai’s Cloud.

About 20% of Stargate funds are expected to be capital, with the remainder funded through secured debt against assets and money flow, the report said. Openi, who reached a $ 157 billion rating last year, is also negotiating to become a lucrative company to facilitate additional funding.